Picture this:

You are enjoying a meal with a group of friends.

Quite casually, you mention that you are working towards paying off your mortgage to live your life debt-free.

Of course you’ll get high-fives from some of your friends.

But you can surely count on someone to say “I will never do that!”

Someone will ask “why?”

They will thoroughly explain the importance of their mortgage interest deduction and saving on their taxes

With great passion, they’ll declare their commitment to “never give Uncle Sam an extra dollar!”

You are not convinced, but you’ve learned over the years to never engage the debate when your friend digs in to defend their position.

Instead, you choose to just be your classy self.

You smile and thank them for giving you something to think about.

But you can’t wait to get home and grab your calculator.

As you arrive home, you grab last year’s tax return, your calculator, a pad and pen.

Nope, better grab a pencil. It might take you a few times to figure this out.

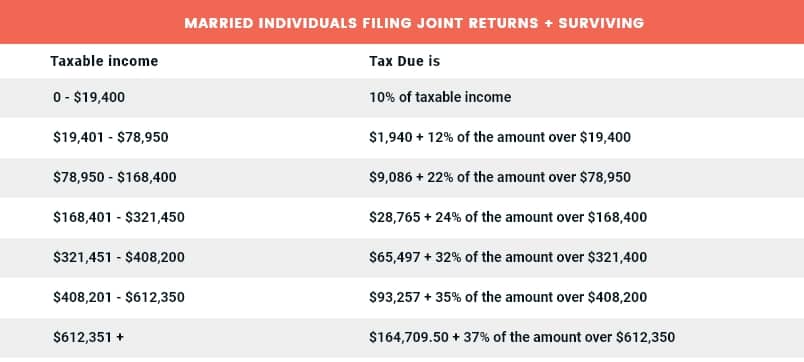

This year it looks like you’ll fall into the 24% tax bracket, with taxable income of $200,000.

You’ll be paying Uncle Sam $36,349 after all of your exemptions and deductions, including your $20,000 deduction for mortgage interest.

Ouch! that hurts! So, what happens if your home was paid in full and you didn’t have that $20,000 mortgage interest deduction.

Well, your taxable income would jump from $200,000 to $220,000.

You would now be paying Uncle Sam $41,149 instead of $36,349, a $4,800 difference.

Let’s review.

You are trying to prove to yourself if the mortgage interest deduction is good for you and your family or if it is a very costly myth and misconception.

You are currently paying $20,000 in mortgage interest… so you can save $4,800 in federal income taxes

If you like that math, please give us as many dollars as you can. We’ll give you quarters back in exchange.

(Of course you would never want to do that, but please contact us now if you do! ?)

Actually, it’s even worse.

We’ll keep the math simple and examine the impact of keeping your mortgage an extra 22 years rather than paying it off.

You would be paying over $400,000 in interest to save a little more than $100,000 in taxes.

Wouldn’t your family be better off paying a little more to Uncle Sam to keep over $300,000?

Don’t buy in to the mortgage interest deduction myth. It’s really not mortgage magic, it’s just math!