Jack shopped long and hard for his 30-year mortgage to find the lowest fixed interest rate possible.

He eventually locked in the best available fixed rate and set up automatic withdrawals from his checking account each month.

Jack’s mortgage was now in “set it and forget it” mode.

But how much would his low rate mortgage cost him over the next 30 years?

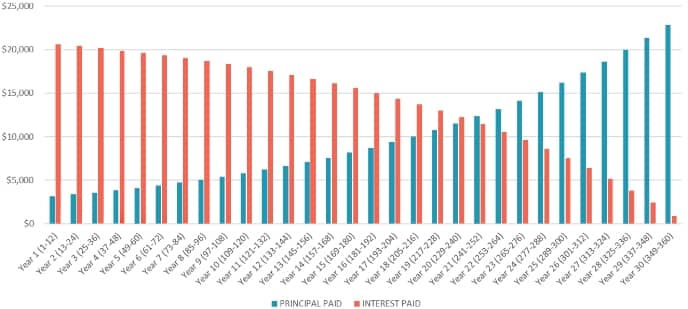

It would take Jack 22 years to pay more principal than interest on his mortgage.

He would pay over $700,000 for his $300,000 home, including over $400,000 in interest.

Jill also purchased a $300,000 home.

But Jill focused on interest cost rather than interest rate.

She chose a Life Changer Loan.

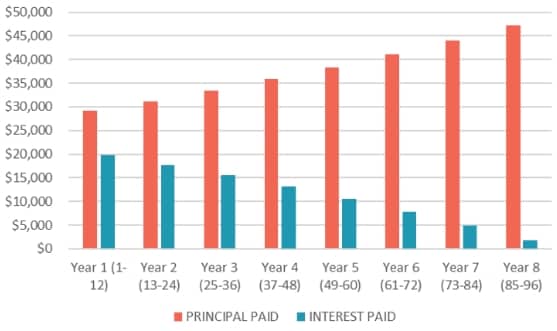

Jill’s $300,000 home was paid off in just eight years at a total cost of less than $400,000.

She saved over $300,000 in interest costs, paying less than $100,000 in interest.

Now Jill could truly “set it and forget it” and invest her savings rather than pay the mortgage company for an extra 22 years!

You don’t have to succumb to the interest rate myth like Jack.

You can choose, just like Jill, to own your home “free and clear” decades sooner.

How much could a Life Changer Loan save you and your family?

What could it mean to your children and grandchildren?